A complete explanation of material alteration in negotiable instruments: definition, examples, legal effects, rules under the Negotiable Instruments Act, and implications for banking professionals in Bangladesh.

Notice

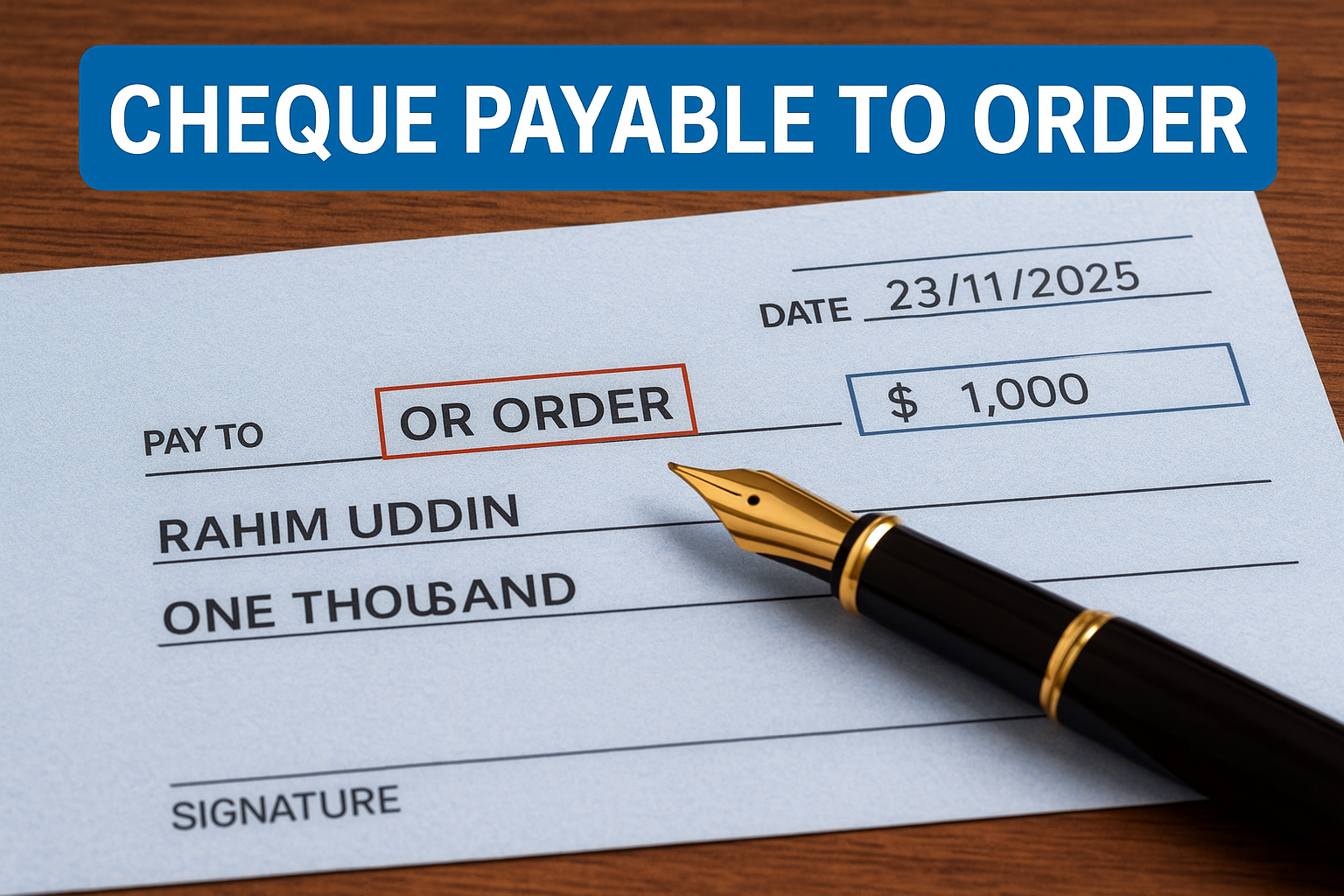

Cheque Payable to Order – Meaning, Features, Rules & Banking Examples

A complete guide to cheque payable to order: definition, legal rules, features, endorsement process, difference with bearer cheque, banking examples, and exam-focused explanations for Bangladeshi banking professionals.

Endorsement and Its Effects

Learn about endorsement and its effects on negotiable instruments like cheques, bills of exchange, and promissory notes. Understand types, legal implications, and banking impact.

Protected: 121st Prize Bond Draw 2025 – Full List of Winning Numbers and Prize Details

There is no excerpt because this is a protected post.

Negotiation of Negotiable Instruments: Meaning, Rules, Endorsements, Examples

Negotiations are essential in business, banking, and personal life. Learn the definition, types, importance, and key strategies of negotiation with real-life examples.