Introduction:

The Negotiable Instruments Act, 1881 is a vital piece of legislation in the banking and financial sectors of Bangladesh, India, and other South Asian countries. It governs the use of instruments like cheques, bills of exchange, and promissory notes in commercial transactions.

What is a Negotiable Instrument?

A negotiable instrument is a written document guaranteeing the payment of a specific amount of money to a specified person or the bearer of the document. These instruments are easily transferable and play a critical role in banking and trade.

Main Types of Negotiable Instruments:

According to the Act, the three main types are:

- Promissory Note:

A written promise to pay a certain amount of money to a specific person or bearer.

Example: “I promise to pay BDT 10,000 to Mr. Rahim on demand.” - Bill of Exchange:

A written order by one party to another to pay a certain sum to a third party on demand or at a fixed date.

Used in trade finance. - Cheque:

A bill of exchange drawn on a banker, payable on demand.

Most common negotiable instrument in banking.

Key Features of Negotiable Instruments:

- Transferable by delivery or endorsement

- Assures payment

- Contains an unconditional promise or order

- Legally enforceable

- Must be in writing

Important Sections of the Act:

- Section 4: Promissory Note

- Section 5: Bill of Exchange

- Section 6: Cheque

- Section 13: Negotiable Instrument – Definition

- Section 138: Dishonour of Cheque – Legal Penalty

Significance in Banking:

- Facilitates smooth financial transactions

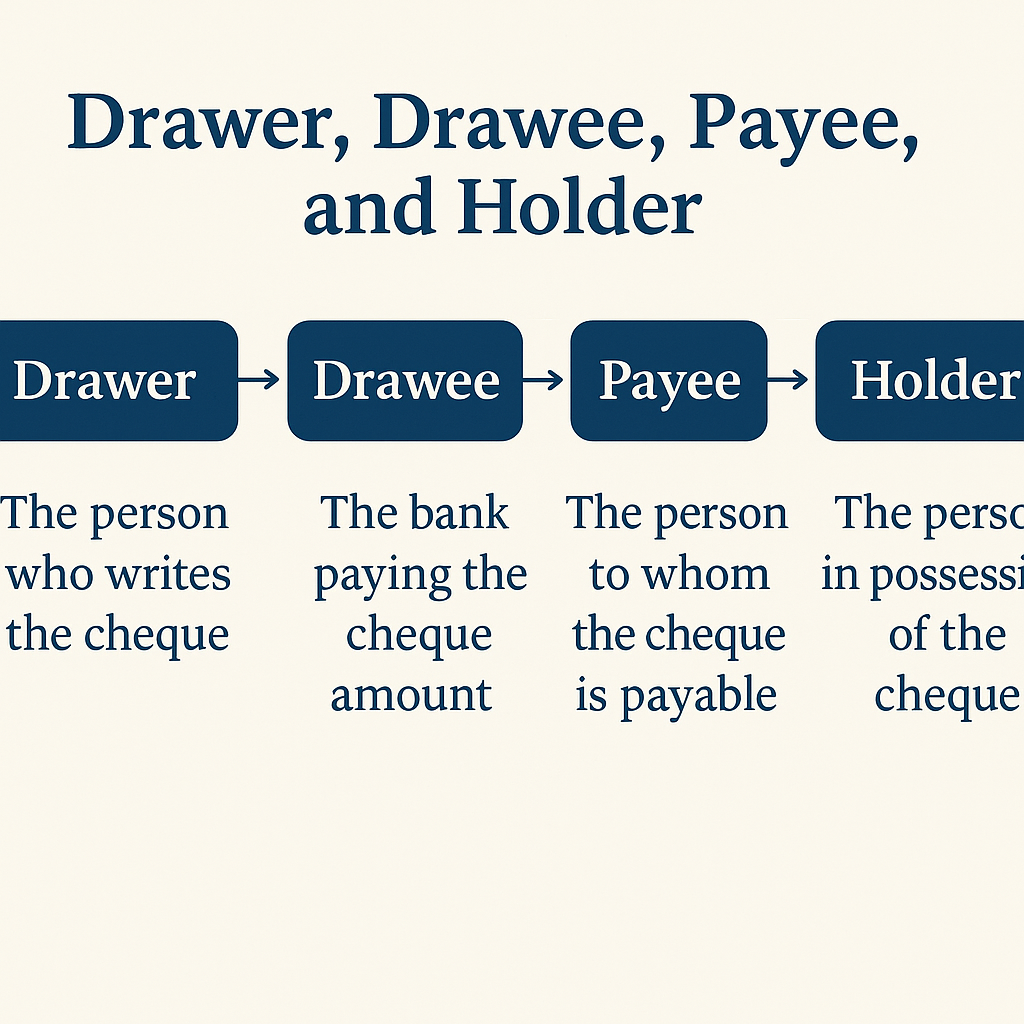

- Legally protects the drawer and payee

- Helps resolve cheque dishonor cases

- Promotes trust in commercial payments

- Essential in credit systems and bill discounting

Offence for Dishonour of Cheque – Section 138:

If a cheque is dishonoured due to insufficient funds, legal action can be taken under Section 138. The drawer may face a fine or imprisonment, which ensures credibility in cheque-based transactions.