Bankruptcy Act, 1997 – Legal Framework of Insolvency in Bangladesh

The Bankruptcy Act, 1997 provides the legal basis for declaring individuals or entities as bankrupt in Bangladesh. It aims to balance the rights of creditors with the need to protect debtors who are unable to meet their financial obligations.

Purpose of the Bankruptcy Act

- To establish an organized legal procedure for declaring bankruptcy

- To ensure fair treatment of both debtors and creditors

- To enable proper distribution of the debtor’s assets

- To offer a chance for the debtor to start fresh, financially

Who Can File for Bankruptcy?

- Debtors: Individuals or business entities unable to pay their debts may voluntarily file a petition.

- Creditors: Creditors can also initiate bankruptcy proceedings if debts remain unpaid after due notice.

Key Provisions of the Act

- Minimum Debt Requirement: A debtor must owe a minimum amount (as specified in the Act) to qualify for bankruptcy.

- Insolvency Declaration: The court assesses whether the debtor is truly insolvent before declaring bankruptcy.

- Appointment of Receiver: A court-appointed receiver manages the debtor’s property and distributes it among creditors.

- Discharge of Debts: Once the process is complete, the debtor may be discharged from most financial obligations.

Legal Procedures

- Filing of bankruptcy petition

- Preliminary hearing and verification of debt

- Appointment of official receiver

- Publication of bankruptcy status

- Asset liquidation and distribution

- Final discharge of the debtor

Impact on Debtors and Creditors

| For Debtors | For Creditors |

|---|---|

| Relief from legal proceedings | Fair distribution of debtor’s assets |

| Chance to start afresh | Protection of financial rights |

| Negative impact on credit record | Transparency in recovery |

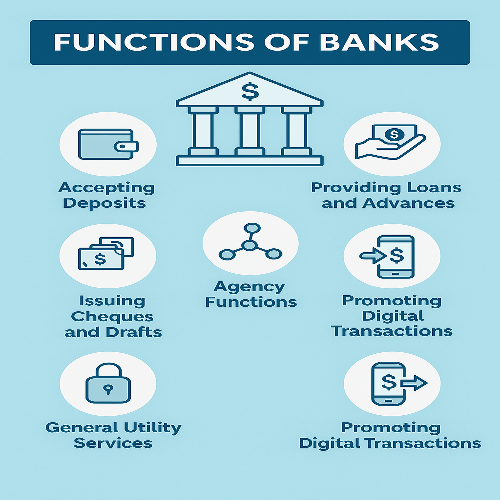

Bankruptcy and Financial Institutions

Banks and financial institutions must take the Bankruptcy Act into account when structuring loans, managing NPAs (Non-Performing Assets), and initiating recovery actions. It also supports responsible lending and credit risk management.

Criticisms and Challenges

- Lengthy legal process

- Lack of awareness among the general public

- Insufficient protection against fraudulent asset transfers

Conclusion

The Bankruptcy Act, 1997 is an essential component of Bangladesh’s financial legal framework. It ensures a structured and fair process for dealing with insolvency, protecting both creditors and debtors while supporting financial discipline and economic stability.

<