A Complete Guide to JAIBB & AIBB Examinations in Bangladesh

If you are looking to build a strong career in the banking sector of Bangladesh, the Junior Associate of the Institute of Bankers, Bangladesh (JAIBB) and Associate of the Institute of Bankers, Bangladesh (AIBB) examinations are essential qualifications.

These professional banking exams are conducted by the Institute of Bankers, Bangladesh (IBB) to enhance the knowledge and skills of banking professionals.

JAIBB Examination: The First Step in Banking Career

The JAIBB examination is designed to provide fundamental knowledge of banking and finance. It is usually held twice a year and serves as the entry-level certification for bankers.

JAIBB Subjects:

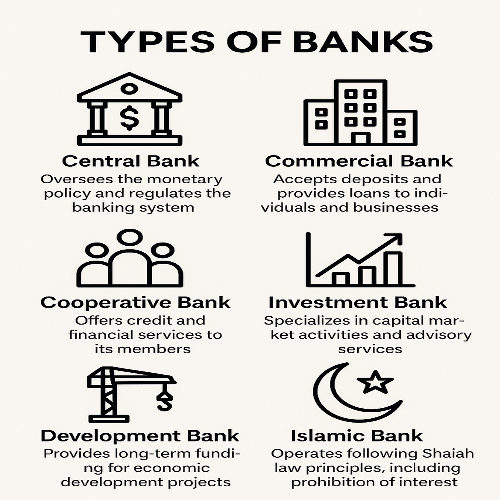

1️⃣ Monetary and Financial System – Understanding the basics of financial systems.

2️⃣ Governance in Financial Institutions – Principles of banking governance and regulations.

3️⃣ Principles of Economics – Economic theories related to banking and finance.

4️⃣ Laws and Practice of General Banking – Legal aspects of banking operations.

5️⃣ Organization & Management – Fundamentals of bank management and operations.

6️⃣ Business Communication in Financial Institutions – Effective communication in banking.

✅ Passing JAIBB establishes a strong foundation in banking, making professionals more capable of handling banking operations efficiently.

AIBB Examination: Advancing Banking Expertise

The AIBB examination is an advanced-level certification that builds on JAIBB knowledge. It focuses on specialized banking areas and enables professionals to make better decisions in complex financial matters.

AIBB Subjects:

✔ Risk Management in Financial Institutions

✔ Credit Operations and Management

✔ Trade Finance and Foreign Exchange

✔ Information and Communication Technology in Financial Institutions

✔ Treasury Management in Financial Institutions

✔ Accounting for Financial Institutions

✔ Agriculture & Microfinance

✔ Sustainable Finance

✔ Shariah-Based Banking

✔ Investment Banking

✔ Management Accounting

✔ Marketing and Branding in Financial Services

✔ Financial Crime and Compliance

🏆 AIBB certification is highly valued as it enhances a banker’s ability to handle advanced financial operations, risk management, and regulatory compliance.

Related Posts You May Like:

📌 Measure of Money Supply

📌 Demand for Money in the Monetary and Financial System

📌 Kinds of Money

📌 Understanding Narrow Money and Broad Money

How to Prepare for JAIBB & AIBB Examinations?

📖 1. Understand the Syllabus

A clear understanding of the exam syllabus will help in effective preparation. Focus on key subjects and prioritize important topics.

📚 2. Collect Study Materials

Use recommended books, online resources, and previous question papers to enhance your knowledge.

📝 3. Solve Past Questions

Practicing previous exam papers will familiarize you with the question pattern and improve time management.

👥 4. Join Study Groups

Engaging with other candidates through study groups can provide valuable insights and help in understanding complex topics.

📊 5. Stay Updated with Banking Trends

Since banking regulations and financial systems evolve, staying informed about industry updates will give an added advantage in the exams.

Final Thoughts

Achieving JAIBB and AIBB certification can significantly enhance career growth in Bangladesh’s banking sector. These qualifications validate a banker’s expertise and open opportunities for promotions and higher responsibilities. With proper planning and dedication, success in these exams is achievable.

📢 For more banking exam resources and study tips, stay connected with Banking Professional Exam Assistant.