Constituents of the Monetary System – Key Components Explained

A well-functioning monetary system is essential for maintaining economic stability, facilitating financial transactions, and regulating the supply of money. It consists of several key components that influence the flow of money and ensure financial stability.

In this post, we will discuss:

✔ The main components of the monetary system

✔ Their roles and significance

✔ How they impact economic stability

1. Money Supply

The money supply refers to the total amount of money available in an economy. It is classified into different categories based on liquidity:

🔹 M1 – Physical cash and demand deposits (highly liquid)

🔹 M2 – M1 + Savings deposits and small time deposits

🔹 M3 – M2 + Large time deposits and institutional funds

✅ Importance:

✔ Regulates economic growth

✔ Helps control inflation

💡 Related Reading:

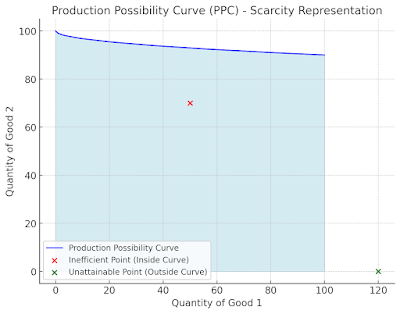

➡ Scarcity in Economics: Meaning & Examples

2. Currency System

The currency system includes coins, banknotes, and digital currency issued by the central bank.

🔹 Plays a crucial role in controlling inflation

🔹 Helps facilitate domestic and international trade

✅ Importance:

✔ A stable currency system maintains purchasing power

✔ Strengthens economic confidence

💡 Related Reading:

➡ Micro vs. Macro Economics: Understanding the Differences

3. Banking System

The banking system is the backbone of the monetary system and operates at three levels:

✔ Central Bank (e.g., Bangladesh Bank) – Controls money supply and monetary policy

✔ Commercial Banks – Provide loans, accept deposits, and facilitate transactions

✔ Non-Banking Financial Institutions (NBFIs) – Offer investment, insurance, and financial services

✅ Importance:

✔ Supports economic growth by providing credit and investment opportunities

✔ Ensures liquidity in the financial market

💡 Related Reading:

➡ Financial Institutions Act 1993: Overview

4. Monetary Policy

Monetary policy is implemented by the central bank to control inflation and economic growth. It consists of:

🔹 Expansionary Policy – Increases money supply to boost economic activity

🔹 Contractionary Policy – Reduces money supply to control inflation

✅ Importance:

✔ Helps stabilize inflation rates

✔ Supports employment and economic growth

💡 Related Reading:

➡ Bangladesh Bank Order 1972: Overview

5. Exchange Rate System

The foreign exchange system determines how currencies are valued and exchanged. There are two main types:

🔹 Fixed Exchange Rate – The currency is pegged to another stable currency (e.g., USD)

🔹 Floating Exchange Rate – Market forces determine the exchange rate

✅ Importance:

✔ Influences international trade and investment

✔ Impacts inflation and interest rates

💡 Related Reading:

➡ Positive vs. Normative Economics

6. Payment Systems

Modern economies rely on efficient payment systems for smooth transactions, including:

✔ Cash transactions

✔ Bank transfers

✔ Digital wallets and mobile banking

✅ Importance:

✔ Ensures quick and secure financial transactions

✔ Reduces reliance on physical cash

💡 Related Reading:

➡ Different Payment Options: A Comprehensive Guide

7. Financial Markets

Financial markets play a crucial role in the monetary system by facilitating investments and capital flow. They include:

✔ Stock Markets – Trading shares and securities

✔ Bond Markets – Debt financing

✔ Derivatives Markets – Risk management instruments

✅ Importance:

✔ Helps businesses raise capital

✔ Provides investment opportunities for individuals and institutions

💡 Related Reading:

➡ Basel’s Principles on Corporate Governance

Final Thoughts

A well-regulated monetary system is essential for economic stability, efficient financial transactions, and inflation control. Understanding these components helps banking professionals and financial analysts navigate complex economic environments.

📌 Want to test your knowledge? Try our interactive quiz below!

➡ Concept of Payment System: A Comprehensive Guide

Monetary System Quiz

Test your knowledge about the monetary system!