Financial Activities Related Laws in Bangladesh

Understanding the legal framework behind financial activities is essential for banking professionals, finance students, and entrepreneurs. In Bangladesh, several laws regulate banking, finance, insurance, and digital transactions. This post provides a clear overview of the most important financial laws applicable in the country.

1. Bangladesh Bank Order, 1972

- Established the Bangladesh Bank as the central authority.

- Empowers the Bank to implement monetary policies and supervise financial institutions.

- Key for ensuring financial system stability in Bangladesh.

2. Bank Companies Act, 1991 (Amended)

- Governs the establishment and regulation of commercial banks.

- Includes provisions for capital requirements, loan classification, and corporate governance.

- Aims to protect depositors and enhance banking sector transparency.

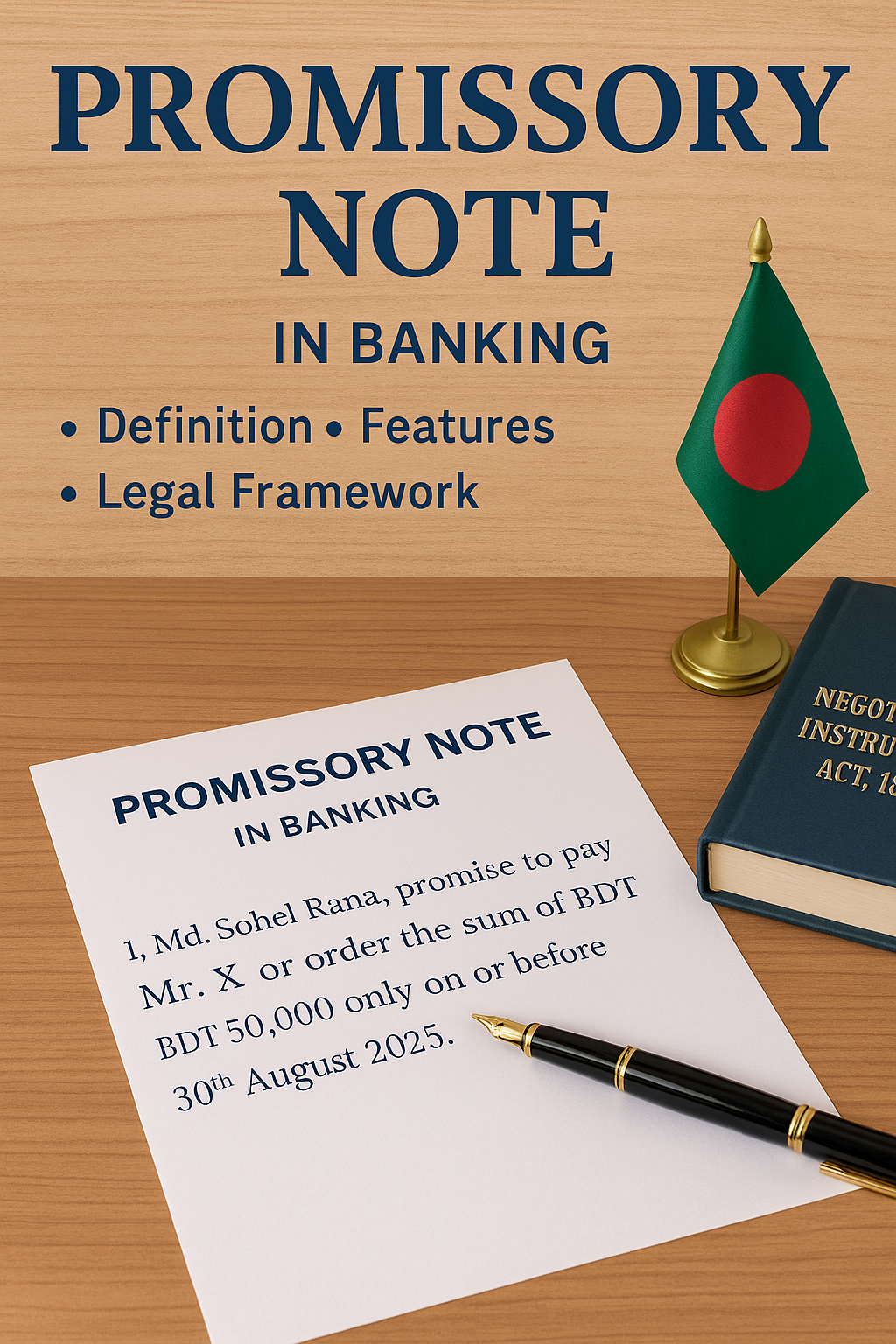

3. Negotiable Instruments Act, 1881

- Applies to promissory notes, cheques, and bills of exchange.

- Defines rights and liabilities of parties involved in negotiable instruments.

- Vital for banking professionals handling customer transactions.

4. Money Laundering Prevention Act, 2012

- Prevents conversion of illegal money into legitimate sources.

- Mandates reporting of suspicious transactions to Bangladesh Financial Intelligence Unit (BFIU).

- Essential for maintaining the integrity of the financial system.

5. Financial Institutions Act, 1993

- Regulates Non-Banking Financial Institutions (NBFIs).

- Includes licensing, auditing, and reporting obligations.

- Ensures financial accountability of leasing and investment companies.

6. Securities and Exchange Ordinance, 1969

- Regulates the stock market and securities trading.

- Empowers BSEC to supervise listed companies and prevent insider trading.

- Protects investors and ensures market fairness.

7. Insurance Act, 2010

- Provides guidelines for life and general insurance companies.

- Regulated by Insurance Development and Regulatory Authority (IDRA).

- Protects policyholders and standardizes industry practices.

8. Microcredit Regulatory Authority Act, 2006

- Supervises microfinance institutions like Grameen Bank and BRAC.

- Microcredit Regulatory Authority (MRA) ensures proper licensing and operations.

- Promotes sustainable micro-lending to rural communities.

9. Foreign Exchange Regulation Act, 1947

- Controls foreign exchange dealings and import/export payments.

- Monitored and enforced by Bangladesh Bank.

- Maintains balance of payments and reserves security.

10. Digital Security Act, 2018

- Protects financial data and penalizes cybercrimes.

- Relevant for digital banking and fintech platforms.

- Includes provisions against identity theft and financial fraud.

Conclusion

The above financial laws are essential for maintaining economic discipline and accountability in Bangladesh. Every banking professional and businessperson should be familiar with these regulations to operate effectively and lawfully in the financial sector.