Money supply plays a crucial role in a country’s economic stability. It affects inflation, interest rates, investment, and overall economic growth. But what determines the money supply, and can the central bank directly control it? Let’s explore two key determinants and the central bank’s influence.

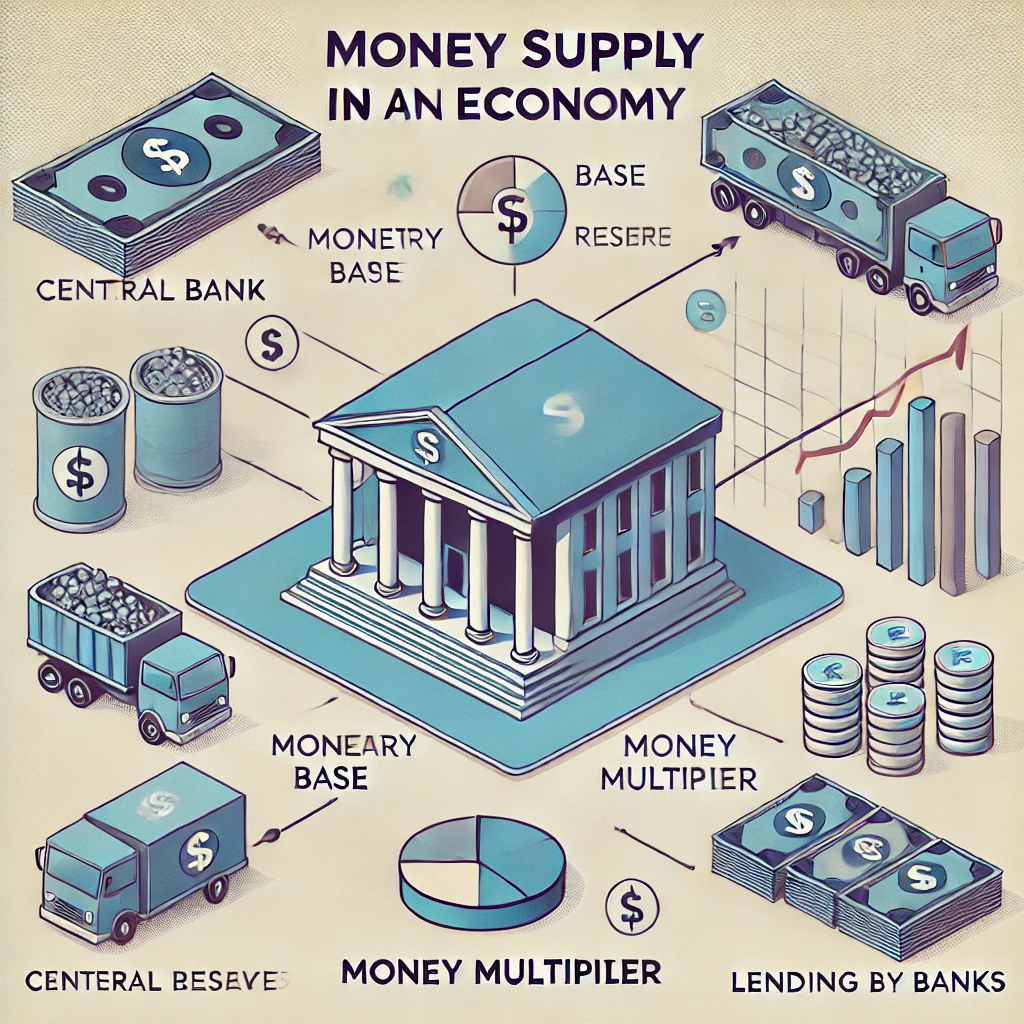

1. Monetary Base (High-Powered Money)

The monetary base includes all currency in circulation plus reserves held by commercial banks at the central bank. It is often referred to as high-powered money because it forms the base upon which other forms of money (like demand deposits) are created.

The central bank influences the monetary base by:

Conducting open market operations (buying/selling government bonds)

Adjusting the discount rate

Changing reserve requirements for banks

2. Money Multiplier

The money multiplier measures how much money is created in the economy from each unit of the monetary base. It depends on:

The public’s preference for holding cash vs. deposits

How much commercial banks are willing to lend

For example, if people prefer holding cash or if banks are cautious in lending, the multiplier will be lower—leading to a smaller increase in the money supply.

Can the Central Bank Directly Control the Money Supply?

No, not entirely. While the central bank (such as Bangladesh Bank) has tools to influence money supply, it cannot control it directly.

This is because:

Banks may not lend out all available reserves

The public’s cash holding behavior can vary

Loan demand may fluctuate based on the economic environment

Thus, the central bank can influence the money supply but not precisely control it.

Conclusion

Understanding the determinants of money supply—monetary base and money multiplier—helps in analyzing how economic policies work. Though the central bank plays a vital role, the final outcome depends on both institutional behavior and public response.

Stay tuned to our blog for more insights on economics and banking in Bangladesh.