Yes, the Bangladesh Bank is widely considered the supreme monetary and banking authority in Bangladesh. This authority is primarily derived from the Bangladesh Bank Order, 1972 (P.O. No. 127 of 1972), which established the central bank and outlined its mandates.

Here’s a discussion of its mandates under the Bangladesh Bank Order, 1972, which solidify its position as the supreme authority:

Key Mandates under the Bangladesh Bank Order, 1972:

- Formulating and Implementing Monetary Policy (Article 7A(a)): The Bangladesh Bank is empowered to formulate and implement the country’s monetary policy. This includes setting interest rates, managing money supply, and controlling credit to achieve macroeconomic goals like price stability and economic growth. This power is fundamental to its role as the supreme monetary authority.

- Managing Currency Issue (Article 23): The Bank has the sole right to issue banknotes in Bangladesh. This monopoly over currency issuance is a defining characteristic of a central bank and a crucial tool for implementing monetary policy.

- Managing Foreign Exchange Reserves and Regulating the Foreign Exchange Market (Article 7A(c) and Article 22): The Bangladesh Bank holds and manages the country’s official foreign exchange reserves. It also regulates the foreign exchange market, including setting exchange rates (though the current regime involves more flexibility) and controlling foreign exchange transactions. This is vital for maintaining external sector stability.

- Regulating and Supervising Banks and Financial Institutions (Article 7A(f) and Part V): The Order grants the Bangladesh Bank the authority to license, regulate, and supervise all scheduled banks and non-bank financial institutions in Bangladesh. This includes setting capital adequacy requirements, prudential guidelines, and conducting inspections to ensure the stability and soundness of the financial system. This regulatory and supervisory role is central to its position as the supreme banking authority.

- Acting as Banker to the Government (Article 20): The Bangladesh Bank acts as the banker, fiscal agent, and advisor to the Government of Bangladesh. It manages the government’s accounts, provides loans and advances to the government (within limits), and advises on financial and economic matters.

- Promoting and Developing the Financial System (Preamble and various articles): While not explicitly listed under Article 7A, the overall spirit and various provisions of the Order mandate the Bangladesh Bank to promote the development of a sound and efficient financial system in Bangladesh. This includes fostering the growth of financial markets and payment systems.

- Ensuring Efficient Payment Systems (Article 7A(d)): The Bank is responsible for promoting, regulating, and ensuring a secure and efficient payment system in Bangladesh. This includes overseeing payment infrastructure and facilitating smooth transactions.

- Maintaining Price Stability (Preamble and Article 7A(a)): A primary objective outlined in the Order is to manage the monetary and credit system with a view to stabilizing domestic monetary value (price stability).

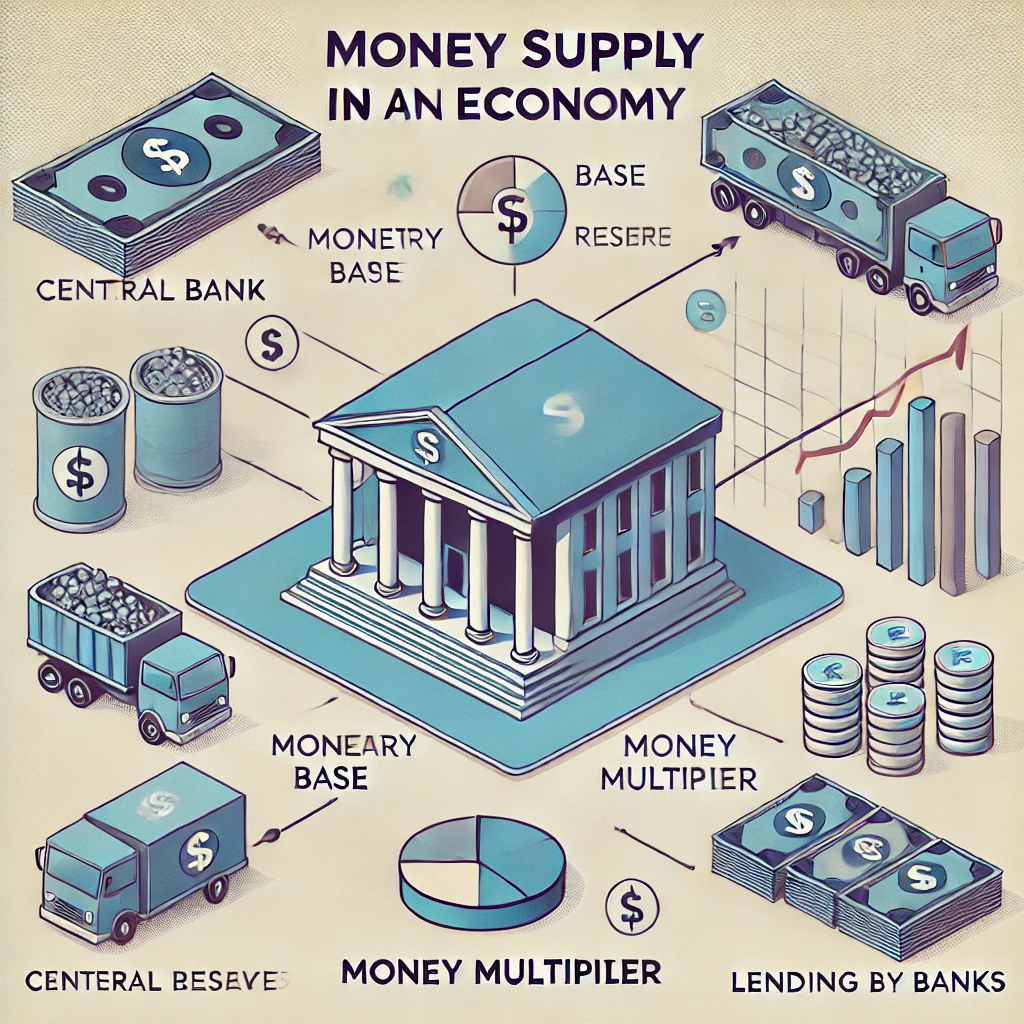

Why these mandates make Bangladesh Bank the supreme authority: - Control over Money Supply and Credit: The power to formulate monetary policy and issue currency gives the Bangladesh Bank ultimate control over the amount of money and credit circulating in the economy. This influences inflation, interest rates, and overall economic activity.

- Oversight of the Financial System: The authority to regulate and supervise banks and financial institutions ensures the stability and integrity of the financial system. This power allows the Bangladesh Bank to set the rules of the game for the banking sector and take corrective actions when necessary.

- Central Role in External Sector: Managing foreign exchange reserves and regulating the foreign exchange market positions the Bangladesh Bank as the key institution for maintaining the country’s external financial stability.

- Government’s Bank: Acting as the government’s banker and advisor gives the Bangladesh Bank a unique and influential position within the state’s financial affairs.

In conclusion, based on the mandates granted under the Bangladesh Bank Order, 1972, it is clear that the Bangladesh Bank is indeed considered the supreme monetary and banking authority in Bangladesh. It possesses the core functions and powers of a central bank, including monetary policy formulation, currency issuance, financial sector regulation and supervision, and acting as the government’s banker. These mandates empower it to oversee and influence the entire monetary and banking landscape of the country.

It’s worth noting that while the Bangladesh Bank holds supreme authority in these domains, its effectiveness can be influenced by various factors, including government policies, global economic conditions, and the efficiency of its own operations. However, legally and functionally, it stands as the apex institution in Bangladesh’s monetary and banking system.