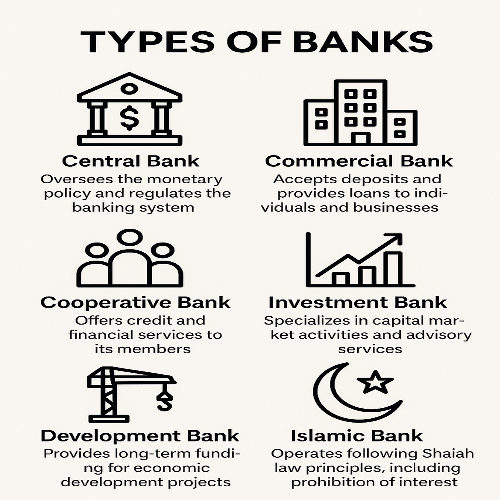

Types of Banks

In the modern financial system, banks play a crucial role in the economic development of a country. Depending on their functions and services, banks can be classified into several categories. Understanding the different types of banks is essential for professionals and students in the banking and finance sectors.

1. Central Bank

The central bank is the apex financial institution responsible for regulating the banking sector of a country. In Bangladesh, the central bank is Bangladesh Bank. It controls the money supply, issues currency, and supervises commercial banks.

2. Commercial Bank

Commercial banks are the most common type of bank that accept deposits and provide loans to the public. They operate to earn profit and cater to individuals, businesses, and corporations. Examples include Sonali Bank, Agrani Bank, and private commercial banks like Dutch-Bangla Bank.

3. Cooperative Bank

Cooperative banks are financial institutions established on a cooperative basis to provide credit to their members. These banks are usually formed in rural or semi-urban areas and serve small-scale industries, farmers, and self-help groups.

4. Development Bank

Development banks are specialized institutions that provide long-term financial assistance to the industrial and infrastructure sectors. In Bangladesh, Bangladesh Development Bank Limited (BDBL) is an example of such a bank.

5. Investment Bank

Investment banks focus on capital market operations such as underwriting, mergers, and acquisitions, rather than traditional deposit-taking or lending activities. They act as intermediaries between investors and corporations.

6. Islamic Bank

Islamic banks operate based on the principles of Shariah law, which prohibits interest. Instead, they follow profit-sharing mechanisms. Islami Bank Bangladesh Limited is a notable example in this category.

7. Foreign Bank

These are branches of international banks operating in a country other than their home nation. Standard Chartered Bank and Citibank are examples of foreign banks in Bangladesh.

Conclusion

Each type of bank serves a unique purpose in the financial system. Understanding their roles helps individuals and businesses make informed financial decisions and enhances overall economic literacy.