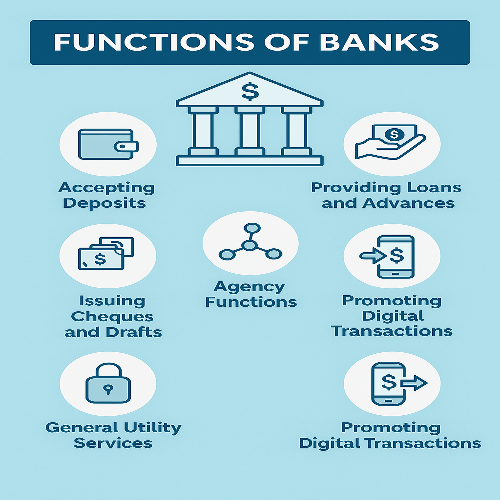

Functions of Banks

Banks play a vital role in the economic development of a country. Their operations go far beyond just accepting deposits and providing loans. Below are the primary and secondary functions performed by banks:

1. Accepting Deposits

This is the basic function of any bank. Banks accept money from the public in the form of savings, fixed, current, and recurring deposits. These deposits are safe and can be withdrawn when needed.

2. Providing Loans and Advances

Banks lend money to individuals, businesses, and the government in the form of loans, overdrafts, and cash credit. They charge interest on these loans, which is a major source of income for banks.

3. Credit Creation

By lending money more than what they receive in deposits (maintaining reserve requirements), banks effectively create credit, which boosts economic activity.

4. Issuing Cheques and Drafts

Banks provide various instruments like cheques, demand drafts, and pay orders to facilitate transactions without cash handling.

5. Agency Functions

On behalf of their customers, banks carry out several agency functions such as:

- Collection of cheques and bills

- Payment of rent, insurance premiums, and utilities

- Acting as trustees or executors

6. General Utility Services

Besides their core services, banks offer a variety of utility functions:

- Locker facilities for safe custody

- Forex services for import/export

- Providing financial advice and investment assistance

- Mobile and internet banking

7. Promoting Digital Transactions

Banks have embraced technology by providing digital wallets, online transfers, and card payments, ensuring faster and safer financial transactions.

Conclusion

Banks are the backbone of any modern economy. Their diversified roles ensure not only financial stability but also the growth and development of the country.