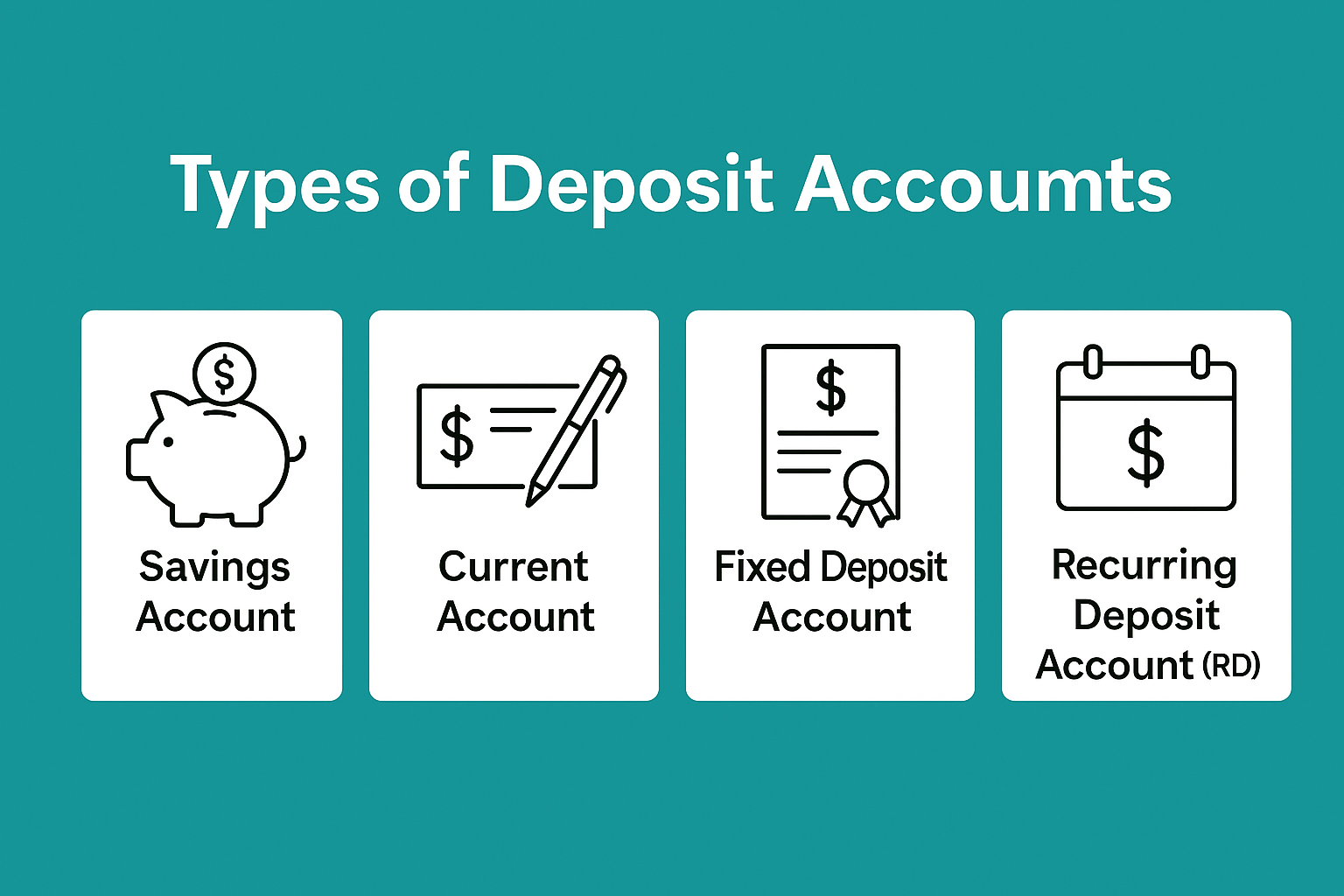

Types of Deposit Accounts

Deposit accounts are the foundation of banking relationships. Banks offer various types of deposit accounts to cater to the different needs of individuals and businesses. Below is an overview of the major types of deposit accounts:

1. Savings Account

A savings account is designed for individuals to save money while earning interest. It encourages regular saving and provides easy access to funds.

- Interest is earned on the deposited amount

- Limited number of withdrawals

- Ideal for salaried individuals and small savers

2. Current Account

This account is mainly used by businesses for frequent transactions. Unlike savings accounts, it does not offer interest in most cases.

- Unlimited deposits and withdrawals

- Designed for business use

- No interest is generally provided

3. Fixed Deposit Account (FD)

A fixed deposit allows customers to deposit a lump sum amount for a fixed period at a predetermined interest rate.

- Higher interest rates than savings accounts

- Tenure ranges from a few days to several years

- Premature withdrawal may incur penalties

4. Recurring Deposit Account (RD)

An RD account is ideal for individuals who want to save a fixed amount every month and earn interest similar to fixed deposits.

- Fixed monthly deposit for a pre-defined term

- Interest is compounded quarterly

- Suitable for goal-based savings

Conclusion

Each type of deposit account serves a specific purpose. Understanding them helps individuals and businesses manage their finances efficiently and select the most suitable option for their needs.