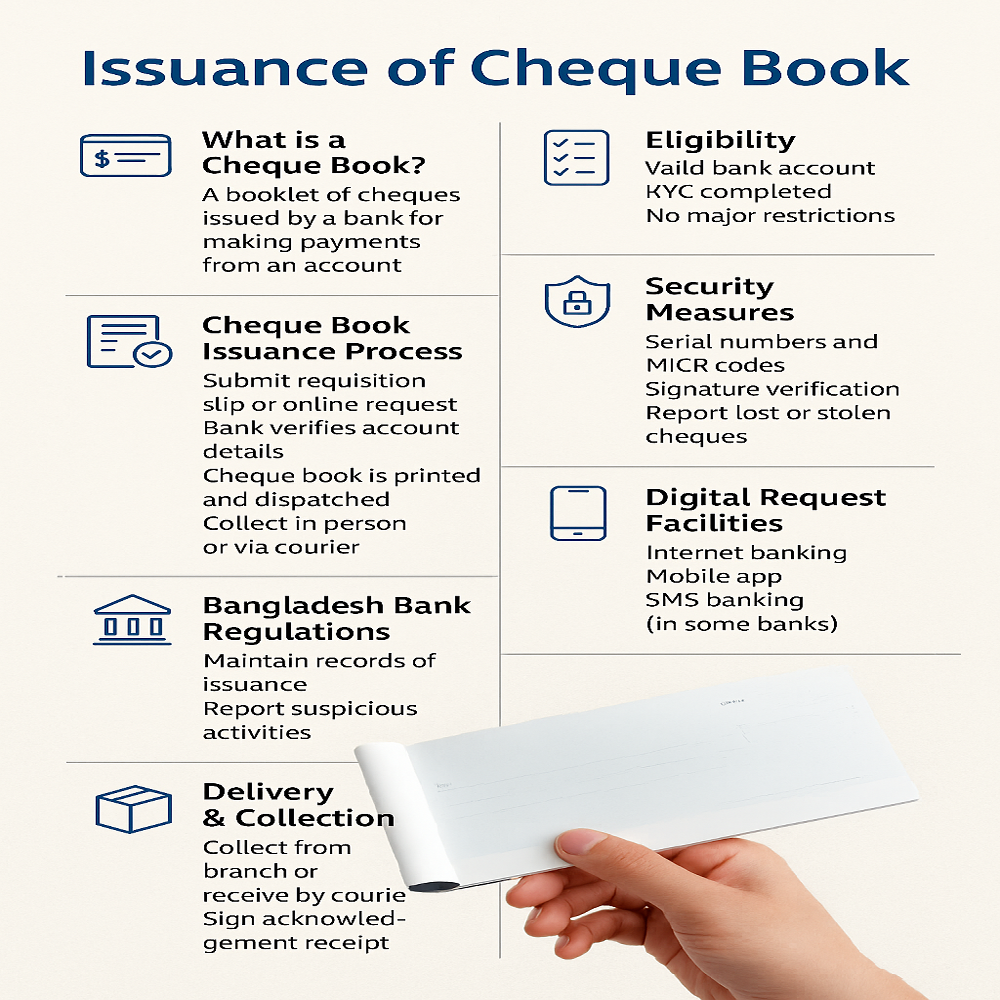

Issuance of Cheque Book in Bangladesh: Process, Rules & Guidelines

The cheque book is an essential banking tool for individuals and businesses to conduct paper-based financial transactions. In Bangladesh, cheque book issuance follows specific processes and compliance measures to ensure security and authenticity. This article outlines the standard procedure, eligibility, and regulatory aspects of cheque book issuance.

📌 What is a Cheque Book?

A cheque book is a booklet issued by a bank containing a number of pre-printed cheques that the account holder can use to make payments from their bank account. Each cheque contains vital details such as account number, MICR code, and the bank branch.

🧾 Eligibility for Cheque Book Issuance

- Must have a valid bank account (Current, Savings, or SND)

- KYC (Know Your Customer) must be completed

- No major account discrepancies or restrictions

📋 Cheque Book Issuance Process

- Submit a cheque book requisition slip or online request through internet banking or mobile app.

- The bank verifies customer details and account activity.

- After approval, cheque books are printed and dispatched to the branch or customer’s address.

- Customer may collect the cheque book in person with ID proof or receive it via courier (if applicable).

🔐 Security Measures

- Cheque books come with serial numbers and MICR codes.

- Signature and identification verification is mandatory.

- Lost/stolen cheque books must be reported immediately.

🏦 Bangladesh Bank Regulations

All banks in Bangladesh are required to maintain proper records of cheque book issuance. Any suspicious request or misuse of cheque leafs must be reported under AML/CFT regulations. Banks must provide secure, tamper-evident packaging for cheque books.

📱 Digital Request Facilities

Many banks now offer cheque book request options via:

- Internet Banking Portals

- Mobile Banking Apps (e.g., Citytouch, iSmart, MyIBBL)

- SMS Banking (in selected banks)

📦 Delivery & Collection

Cheque books can be collected from the branch or delivered to your registered address. In some cases, banks charge a courier fee. Make sure to sign the acknowledgment receipt upon delivery.

🔚 Conclusion

The issuance of a cheque book is a routine but regulated process in banking. For a smooth experience, ensure your account is KYC-compliant and use digital platforms for faster requests. Always store your cheque book securely to avoid misuse.

Written by: Md. Sohel Rana, Officer, Uttara Bank Ltd.