Foreign instruments: definition under the Negotiable Instruments Act, essential features, differences with inland instruments, practical banking examples, and exam-oriented notes for banking professionals.

Tag: Banking Law

Inland Instruments: Definition, Features, Examples & Banking Exam Notes

Inland instruments: definition under the Negotiable Instruments Act, key features, differences with foreign instruments, practical examples, and exam pointers for banking professionals.

Holder in Due Course: Meaning, Rights, and Importance in Negotiable Instruments Law

Holder in Due Course (HDC) is a person who acquires a negotiable instrument in good faith, for value, and before its maturity, thereby enjoying special rights and protections—such as priority in claims against previous defects or defenses. Under the Negotiable Instruments Act, 1881 (Section 9) of Bangladesh, this post explains the definition, conditions, rights/privileges, and examples of HDC in a clear and concise way.

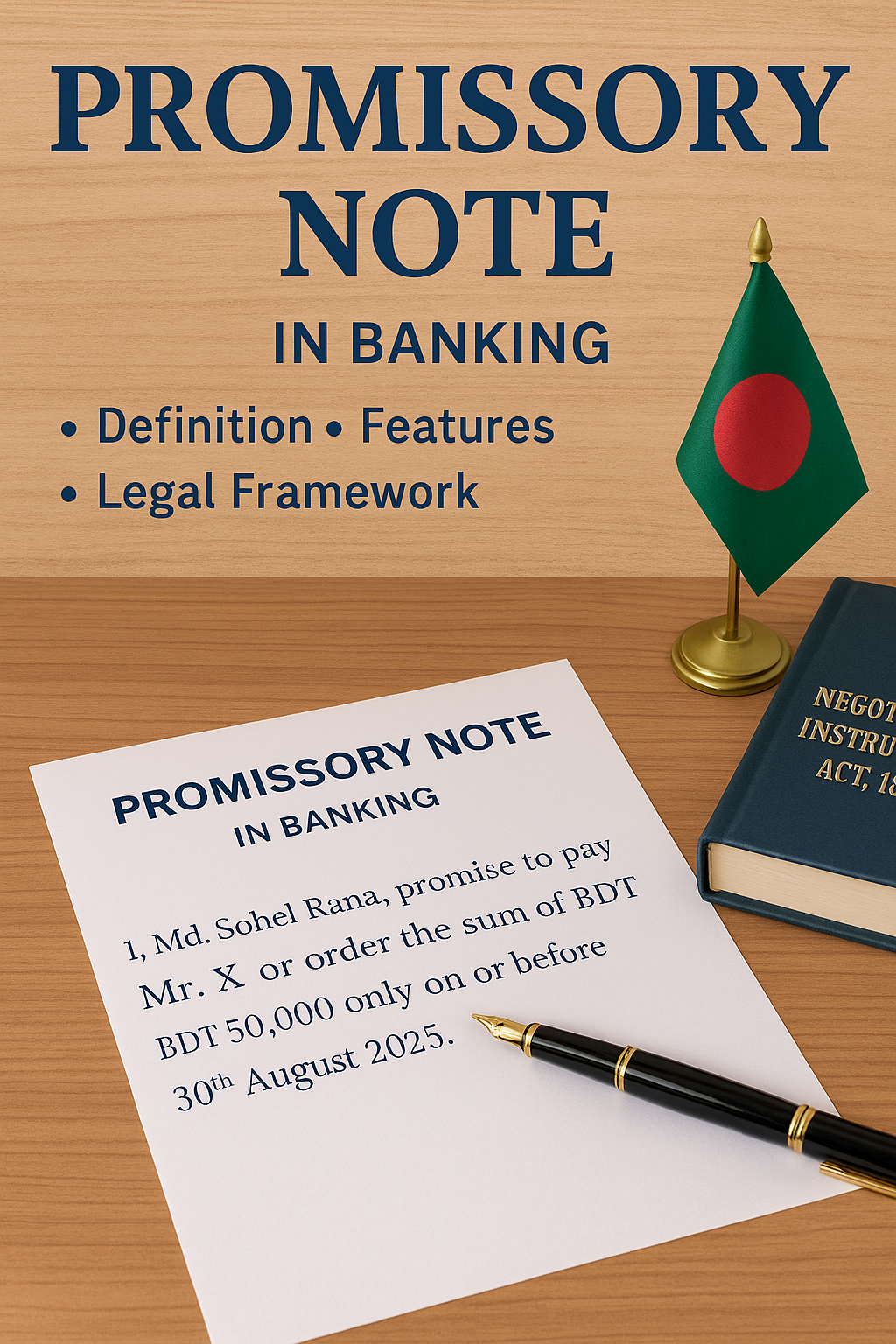

Promissory Note – Definition, Features, and Legal Framework

Learn the definition, features, and legal aspects of Promissory Notes under the Negotiable Instruments Act, 1881 in Bangladesh.

Negotiable Insłtrument – Definition, Features & Types

Learn about Negotiable Instruments, their definitions, features, and types as per the Negotiable Instruments Act 1881 in Bangladesh.