Payment in due course: meaning under the Negotiable Instruments Act, essential conditions, banker’s protection, effects on parties, and practical examples for banking and competitive exams.

Holder in Due Course: Meaning, Rights, and Importance in Negotiable Instruments Law

Holder in Due Course (HDC) is a person who acquires a negotiable instrument in good faith, for value, and before its maturity, thereby enjoying special rights and protections—such as priority in claims against previous defects or defenses. Under the Negotiable Instruments Act, 1881 (Section 9) of Bangladesh, this post explains the definition, conditions, rights/privileges, and examples of HDC in a clear and concise way.

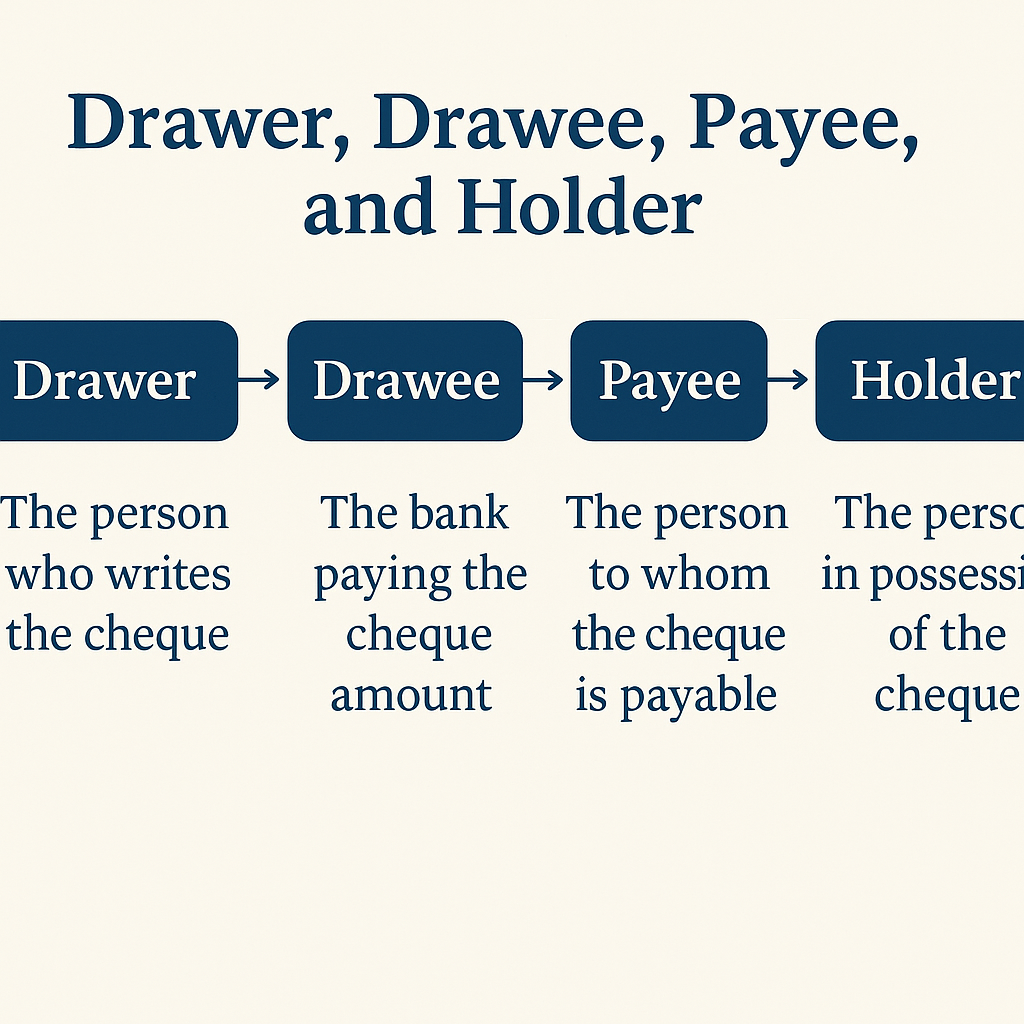

Drawer, Drawee, Payee, and Holder — Cheque Terminology Explained

Learn the meaning of Drawer, Drawee, Payee, and Holder in banking, especially in the context of cheques. Includes examples and easy explanations for Bangladesh banking.

Cheque in Bangladesh — Definition, Types, Rules & Writing Guide

Complete guide to cheques in Bangladesh — definition, key parts, types (bearer, order, crossed), Bangladesh Bank rules, how to write a cheque correctly, and cheque bounce procedure.

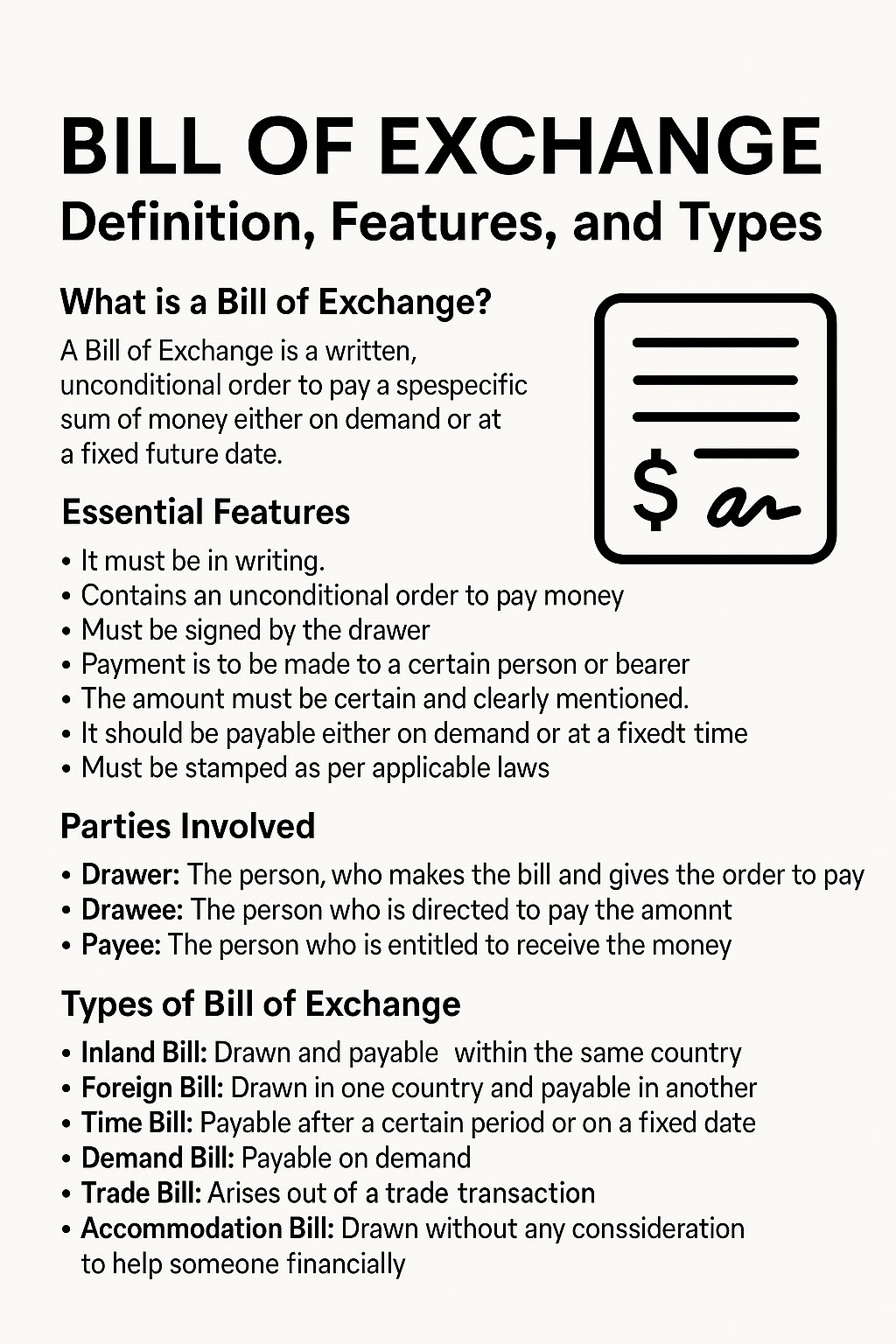

Bill of Exchange – Definition, Features, and Types

Learn about the definition, features, types, and legal framework of a Bill of Exchange. A complete guide for banking professionals and commerce students.