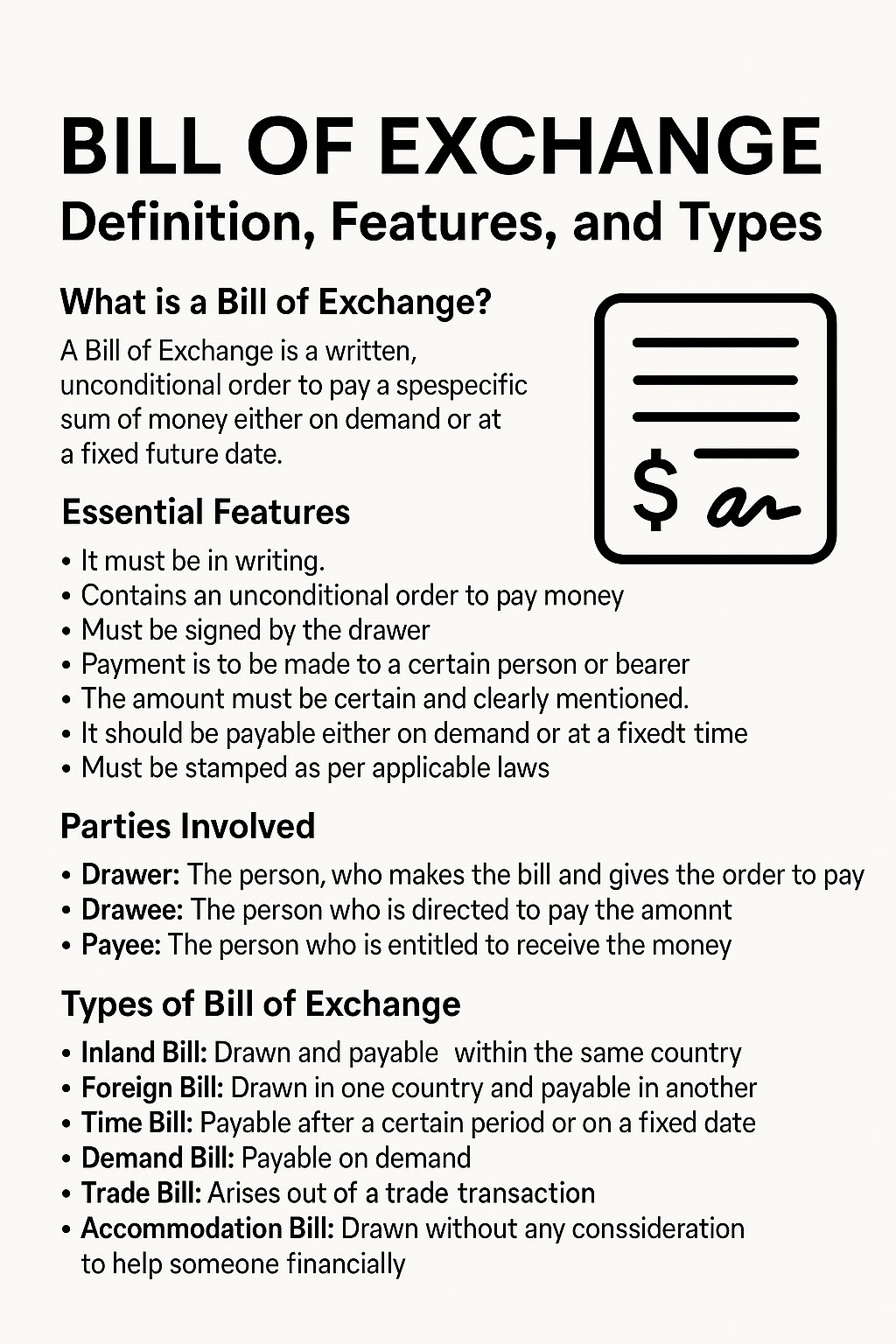

Bill of Exchange – Definition, Features, and Types

Last updated: July 25, 2025

What is a Bill of Exchange?

A Bill of Exchange is a written, unconditional order by one party (the drawer) to another (the drawee) to pay a specific sum of money to a third party (the payee) either on-demand or at a fixed future date. It is widely used in international trade and banking transactions.

Legal Definition

According to Section 5 of the Negotiable Instruments Act, 1881:

“A bill of exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument.”

Essential Features

- It must be in writing.

- Contains an unconditional order to pay money.

- Must be signed by the drawer.

- Payment is to be made to a certain person or bearer.

- The amount must be certain and clearly mentioned.

- It should be payable either on demand or at a fixed time.

- Must be stamped as per applicable laws.

Parties Involved

- Drawer: The person who makes the bill and gives the order to pay.

- Drawee: The person who is directed to pay the amount.

- Payee: The person who is entitled to receive the money.

Types of Bill of Exchange

- Inland Bill: Drawn and payable within the same country.

- Foreign Bill: Drawn in one country and payable in another.

- Time Bill: Payable after a certain period or on a fixed date.

- Demand Bill: Payable on demand.

- Trade Bill: Arises out of a trade transaction.

- Accommodation Bill: Drawn without any consideration to help someone financially.

Importance in Banking and Trade

Bills of exchange serve as a credit instrument and are legally enforceable. They promote trade by allowing sellers to receive payment even before the actual money is paid by the buyer. Banks often discount these bills to provide immediate liquidity.

Conclusion

The Bill of Exchange is an essential instrument in modern financial and commercial transactions. Understanding its types, features, and legal significance is crucial for banking professionals, accountants, and business people.