Negotiable Instrument – Definition, Features & Types

Published on: July 6, 2025 | Category: General Banking

What is a Negotiable Instrument?

A Negotiable Instrument is a written document guaranteeing the payment of a specific amount of money either on demand or at a set time, with the payer named on the document.

In Bangladesh, the rules governing these instruments are laid out in the Negotiable Instruments Act, 1881.

Key Features of Negotiable Instruments

- Transferable from one person to another

- The transferee gets the full legal title

- Must be in writing

- Should be signed by the maker or drawer

- Unconditional promise or order to pay

- Payable either on demand or at a future date

Types of Negotiable Instruments

Under the Act, there are mainly three types of negotiable instruments:

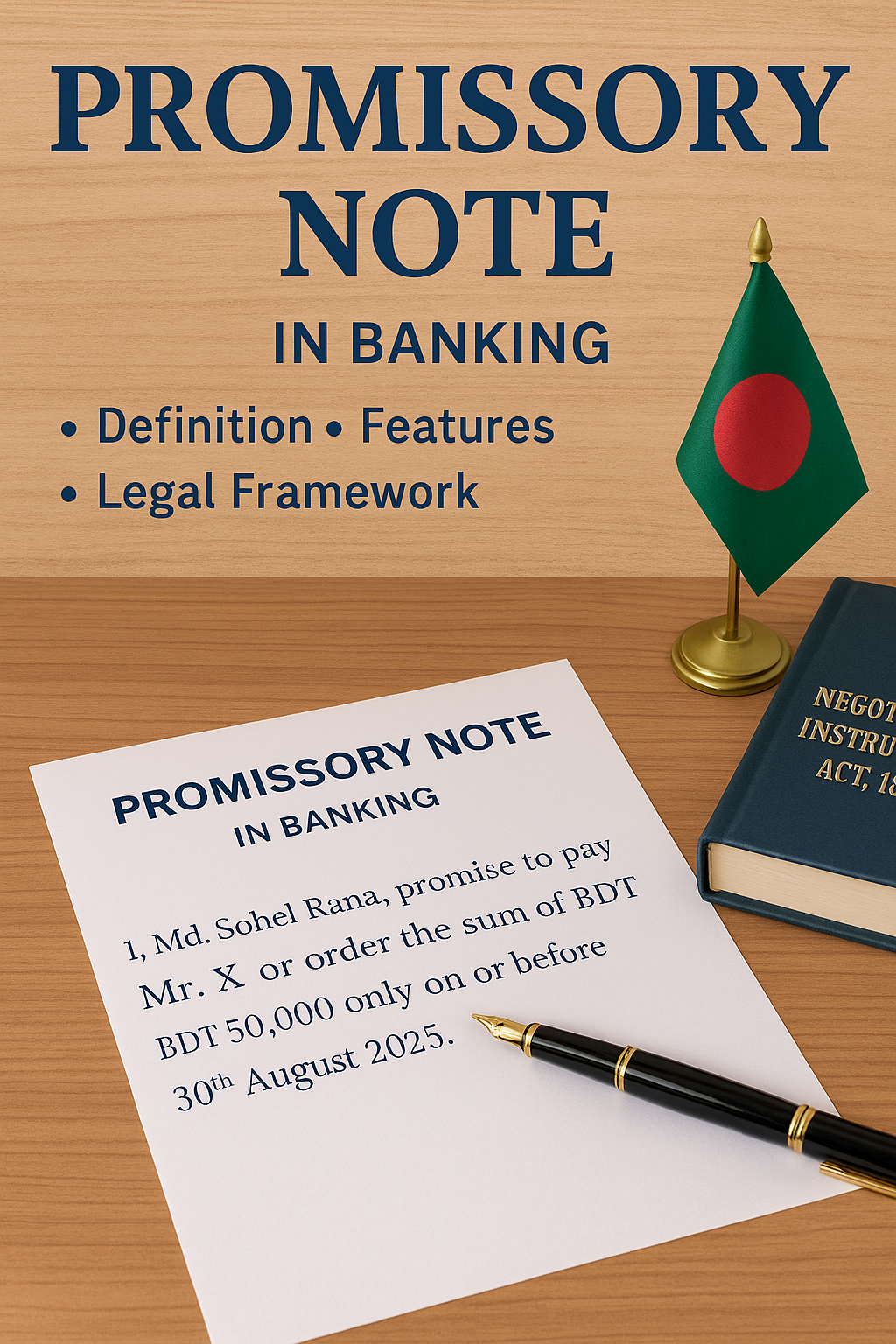

- Promissory Note: A written promise to pay a specific sum to a specific person.

- Bill of Exchange: A written order from one person to another to pay a specified amount to a third person.

- Cheque: A bill of exchange drawn on a banker payable on demand.

Importance in Banking

Negotiable instruments play a vital role in the modern banking system, especially for clearing payments and ensuring smooth commercial transactions.