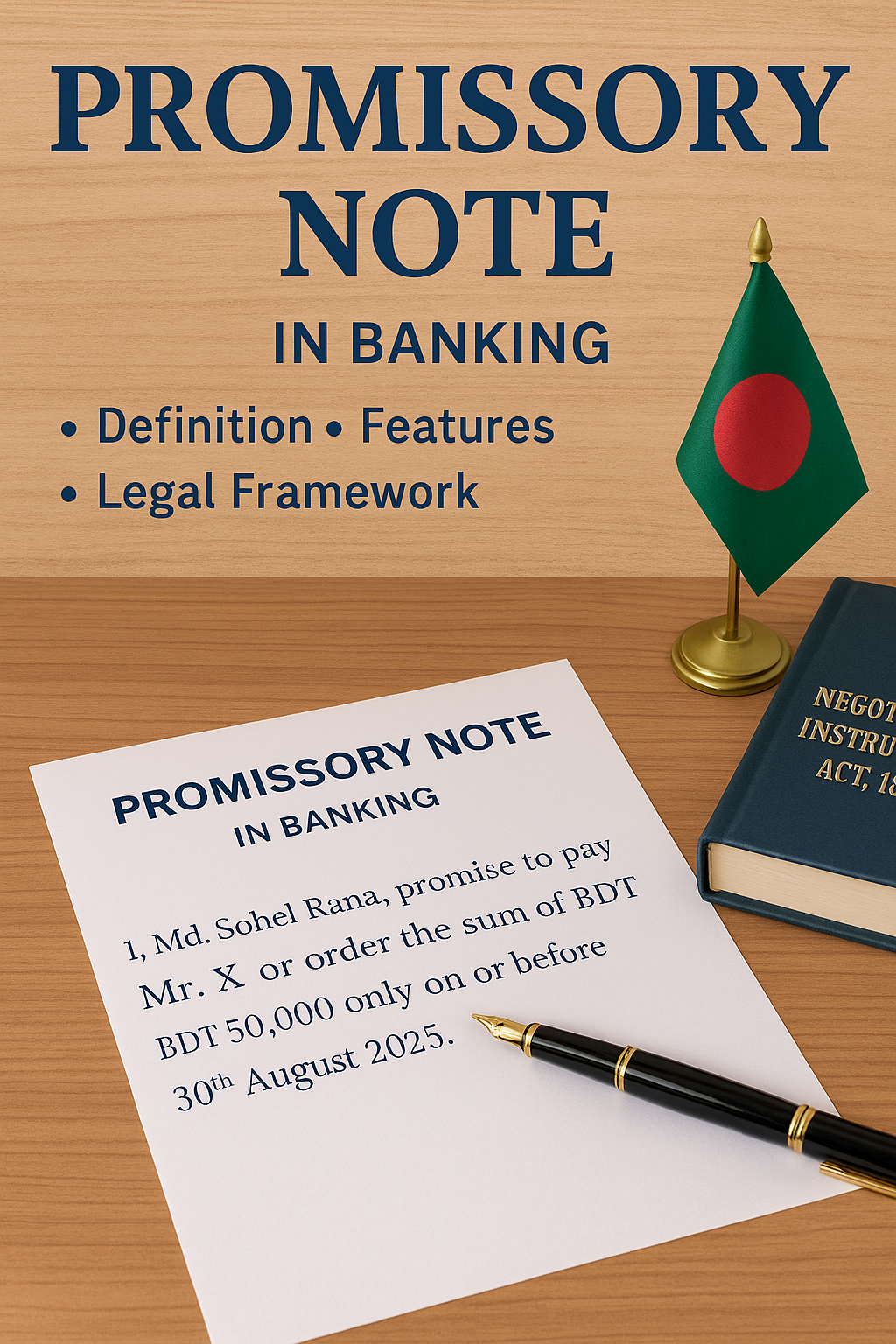

What is a Promissory Note?

A Promissory Note is a financial instrument in which one party (the maker) promises in writing to pay a determinate sum of money to another (the payee), either at a fixed or determinable future time or on demand. It is governed by Section 4 of the Negotiable Instruments Act, 1881.

Essential Features

- Must be in writing

- Contains an unconditional promise to pay

- Signed by the maker

- Specifies a definite sum of money

- Payable to a certain person or to the bearer

- Payable on demand or at a fixed time

Parties Involved

- Maker: The person who makes and signs the note, promising to pay.

- Payee: The person to whom the payment is to be made.

Legal Aspects under Bangladeshi Law

In Bangladesh, a promissory note must comply with the conditions set in the Negotiable Instruments Act, 1881. It is considered a legal document and can be produced in court for recovery if dishonored.

Example Format

“I, Md. Sohel Rana, promise to pay Mr. X or order the sum of BDT 50,000 only on or before 30th August 2025.”